Estate Planning Essentials: Preparing Your Legacy in Mohave County

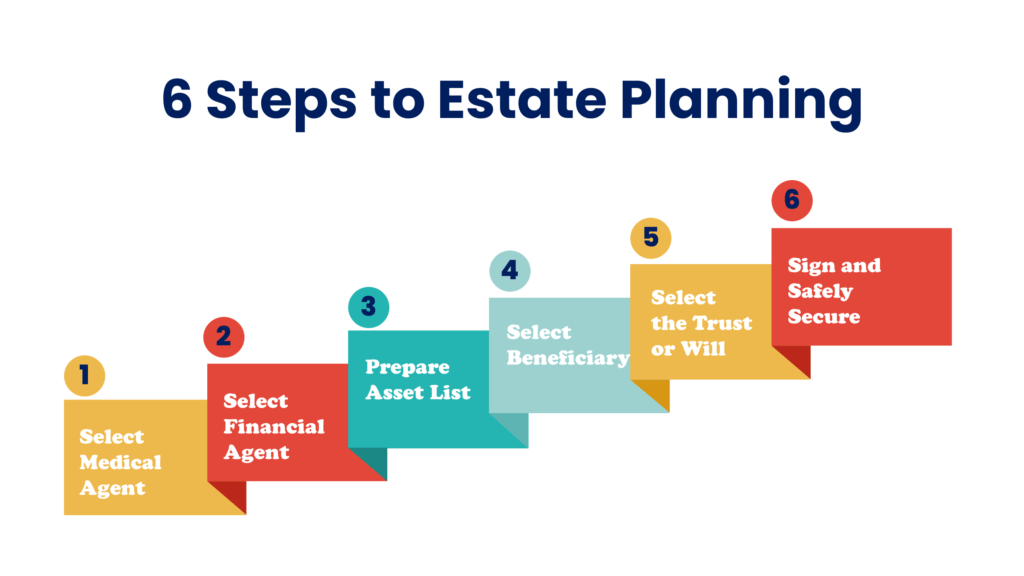

Comprehensive estate planning ensures your wishes are honored. (Image: BoomersHub)

Estate planning is one of those tasks many of us in Kingman and throughout Mohave County prefer to postpone. However, creating a thoughtful estate plan is one of the most considerate acts you can do for your loved ones. At Taylor Family Store LLC, we've seen firsthand how proper planning can make a significant difference during difficult times. This guide will help you understand the essential components of estate planning specific to Arizona residents.

Why Estate Planning Matters in Mohave County

Arizona has specific laws regarding inheritance, probate, and estate taxes that differ from other states. Without proper planning, your estate could face lengthy probate proceedings, potentially higher tax burdens, and distribution that doesn't align with your wishes. A comprehensive estate plan ensures your assets are protected and distributed according to your desires while minimizing stress for your loved ones.

Essential Estate Planning Documents

1. Will

A will is the foundation of any estate plan. It specifies how you want your assets distributed after your death and allows you to name guardians for minor children. In Arizona, for a will to be valid, it must be in writing, signed by you, and witnessed by at least two people. While handwritten (holographic) wills are recognized in Arizona, they can be more easily contested, so a formally prepared will is generally recommended.

2. Trust

Trusts offer more control over how and when your assets are distributed. They can help your estate avoid probate, potentially saving time and money. Living trusts are particularly popular in Arizona as they allow for asset management during your lifetime and seamless transition after death. For Mohave County residents with real estate in multiple states or those concerned about privacy, trusts offer significant advantages.

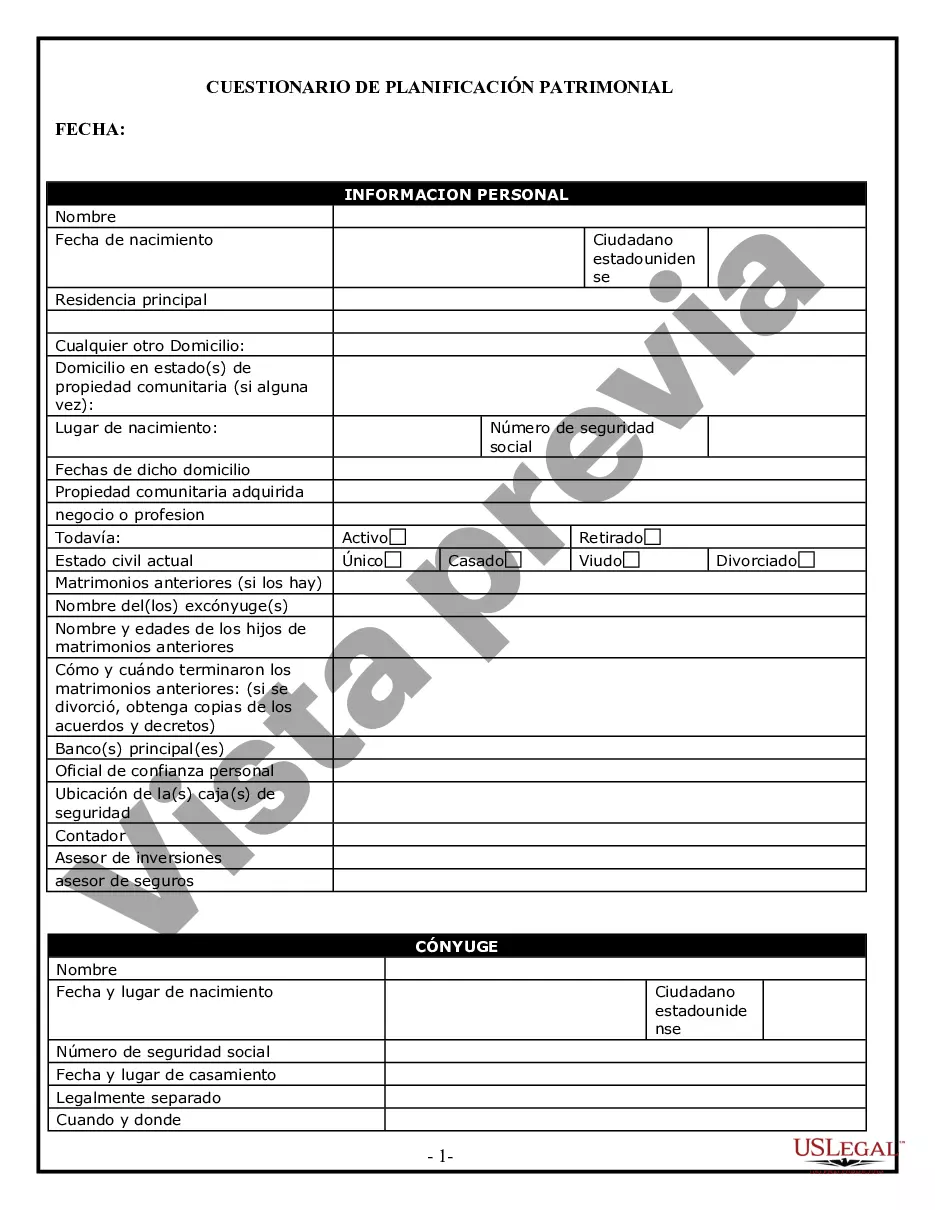

A comprehensive checklist can help organize your estate planning process. (Image: US Legal Forms)

3. Power of Attorney

A financial power of attorney appoints someone to manage your financial affairs if you become incapacitated. In Arizona, you can create a durable power of attorney that remains effective even if you become incapacitated, or a springing power that only takes effect upon incapacity. Consider carefully who you appoint, as this person will have significant control over your finances.

4. Healthcare Directives

Healthcare directives include a living will and healthcare power of attorney. These documents specify your wishes regarding medical treatment if you cannot communicate and appoint someone to make healthcare decisions on your behalf. Arizona has specific forms for these documents, making it important to use state-compliant versions.

5. Beneficiary Designations

Assets like life insurance policies, retirement accounts, and certain bank accounts pass directly to named beneficiaries, bypassing your will. Review these designations regularly, especially after major life events like marriage, divorce, or the birth of a child, to ensure they align with your overall estate plan.

Special Considerations for Arizona Residents

Community Property Laws

Arizona is a community property state, meaning most assets acquired during marriage are owned equally by both spouses. This has significant implications for estate planning, particularly for blended families or those with specific inheritance wishes. Understanding how community property laws affect your estate is crucial for effective planning.

Probate in Mohave County

Arizona offers informal probate processes that can be more streamlined than in some other states. However, probate can still be time-consuming and public. For estates valued under certain thresholds, Arizona also offers simplified probate procedures. Planning to minimize probate can save your heirs both time and money.

Estate planning is especially important for married couples. (Image: Leitner Law PLC)

Digital Assets

In our increasingly digital world, planning for digital assets—from online financial accounts to social media profiles and digital photos—is essential. Arizona has adopted the Revised Uniform Fiduciary Access to Digital Assets Act, which provides a framework for accessing digital assets after death, but specific planning is still necessary.

When to Review Your Estate Plan

Estate planning isn't a one-and-done process. Review your plan regularly, particularly after:

- Major life events (marriage, divorce, birth, death)

- Significant financial changes

- Moving to a new state

- Changes in tax laws

- At least every 3-5 years

Planning for Personal Property

While financial assets often take center stage in estate planning, personal property—furniture, jewelry, art, family heirlooms—can become a source of conflict among heirs. Arizona law allows for a separate personal property memorandum that can be updated without revising your entire will. This document can specify who receives particular items and can help prevent disagreements among family members.

End-of-Life Planning Beyond Legal Documents

Beyond legal documents, consider creating:

- An inventory of assets and where to find important documents

- A list of accounts with usernames and passwords

- Instructions for funeral or memorial preferences

- Letters to loved ones expressing sentiments that might not be included in legal documents

Estate Services for Mohave County Residents

At Taylor Family Store LLC, we understand that estate planning extends beyond legal documents to the practical aspects of managing physical possessions. Our estate services complement your legal planning by helping you organize, downsize, or appraise your possessions. We also provide compassionate assistance to executors and family members handling estates after a loved one has passed. Our local knowledge of Kingman, Bullhead City, and Lake Havasu makes us uniquely positioned to serve Mohave County residents with their estate needs.

Learn More About Our Estate ServicesDisclaimer: This article provides general information about estate planning in Arizona and is not legal advice. Always consult with a qualified attorney for advice specific to your situation.

Add comment

Comments